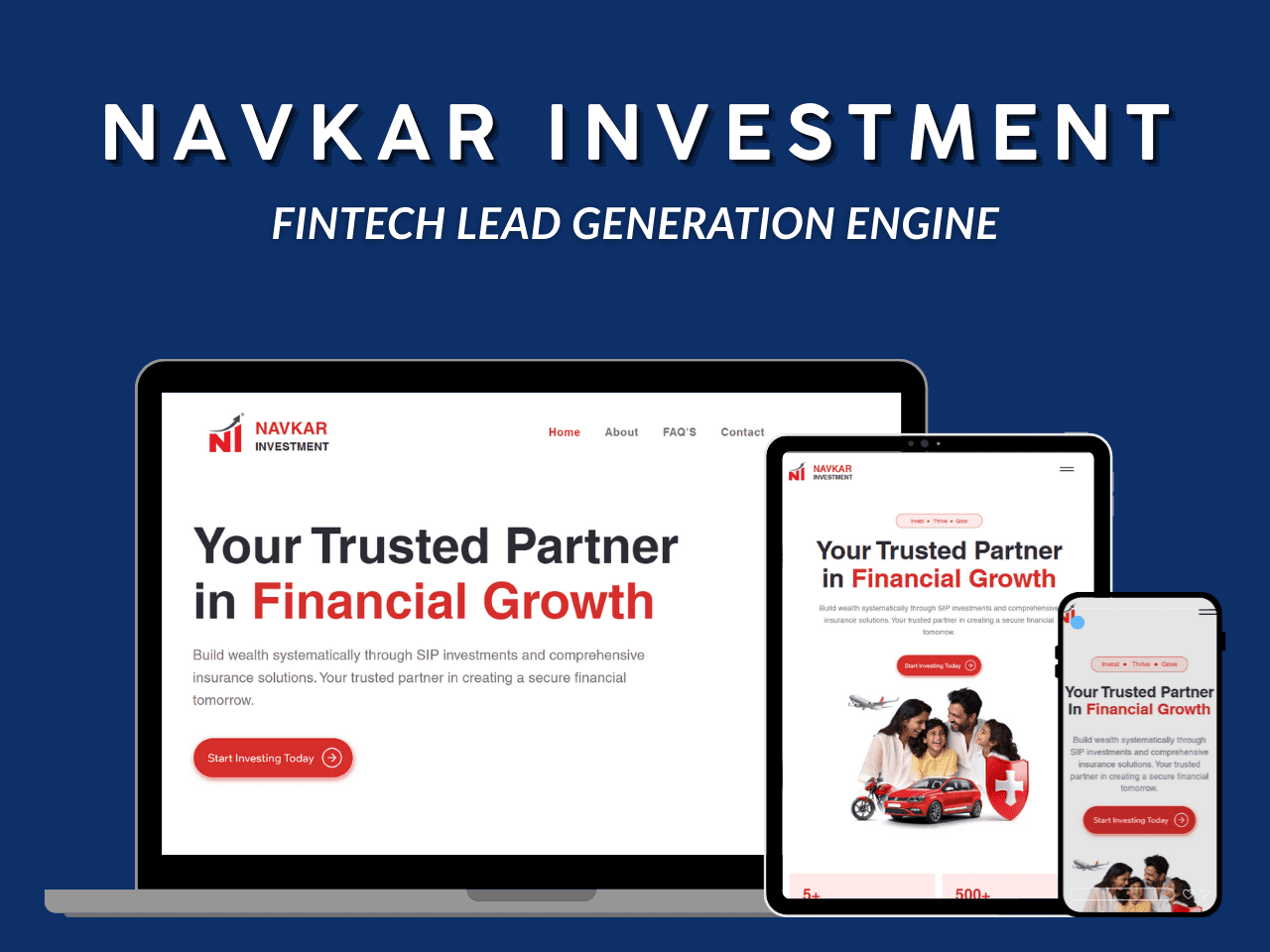

Building the Future of Finance in India. Securely.

We engineer RBI-compliant FinTech solutions that empower India's banks, NBFCs, and insurance leaders to innovate with confidence, attract digital-native customers, and lead the market.

Get a Free FinTech Consultation